UniRouter’s Liquid Staking Architecture

This page offers an in-depth understanding of how UniRouter has enhanced the staking mechanism within the Babylon ecosystem, focusing on Bitcoin staking. Let’s dive into the core components and operational flow of UniRouter’s liquid staking.

Introduction

UniRouter’s liquid staking architecture represents a significant leap in blockchain technology, merging the robustness of Babylon’s Bitcoin staking with the flexibility and liquidity of tokenized assets. This approach allows users to stake their Bitcoin securely while maintaining access to liquid assets, enhancing their participation in decentralized finance (DeFi).

Original Workflow of Babylon Bitcoin Staking

Before delving into the enhancements brought by UniRouter, it’s essential to understand the original workflow of Bitcoin staking in the Babylon ecosystem. This section outlines the foundational process upon which UniRouter’s liquid staking architecture builds.

Babylon’s Bitcoin Staking Process

The staking process in Babylon is designed to allow Bitcoin holders to directly stake their assets onto the Babylon chain. This process is characterized by its emphasis on security and direct asset control, as detailed below:

Staking Transaction Initiation: The staker initiates the process by sending a staking transaction to the Bitcoin chain. This transaction locks the staker’s bitcoin in a self-custodian vault, creating a UTXO (Unspent Transaction Output) with specific spending conditions.

Unlock Conditions: There are two primary conditions under which the staked bitcoins can be unlocked:

Timelock: After a pre-defined period, the staker can use their private key to withdraw the staked bitcoins.

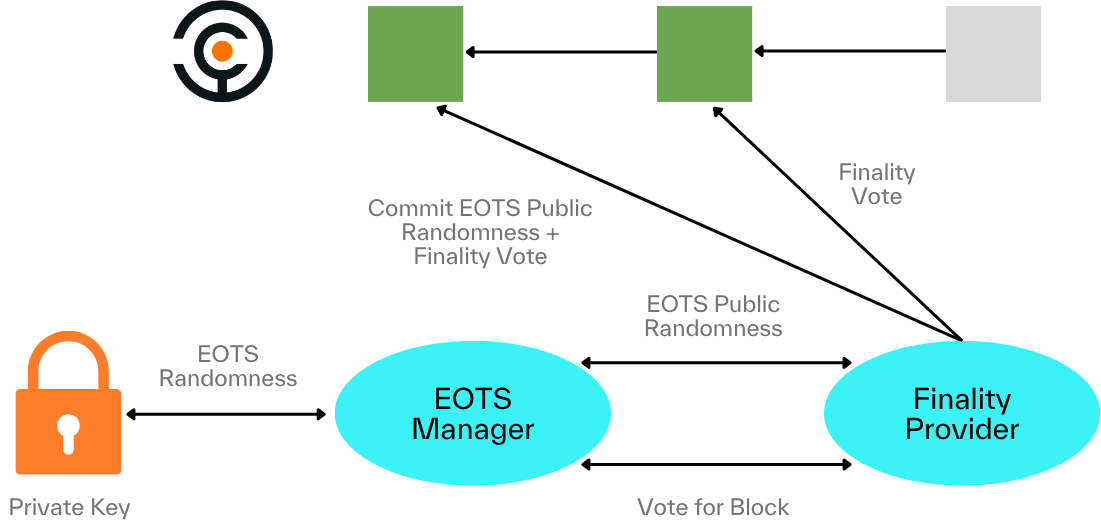

Burnable through EOTS: If the staker equivocates or violates the Babylon protocol, the Extractable One-Time Signature (EOTS) mechanism ensures that their secret key is exposed, triggering a transaction that burns the staked bitcoins.

Validation Participation: Once the staking transaction is confirmed on the Bitcoin chain, the staker can participate in validating blocks on the Babylon chain, employing the EOTS secret key for signing votes or blocks.

Reward Mechanism: By participating in the validation process and adhering to the protocol, stakers earn rewards. These rewards are contingent on honest participation and contribution to the network’s integrity.

Penalty for Dishonesty: In case of dishonest behavior, such as double-spending attacks, the EOTS key exposure leads to a public revelation of the staker’s identity, allowing anyone to initiate a burning transaction of the staker’s bitcoin. This mechanism ensures accountability and discourages malicious activities.

Importance in the Babylon Ecosystem

This original workflow forms the backbone of Babylon’s approach to integrating Bitcoin into its ecosystem, emphasizing security, decentralization, and direct participation in blockchain validation processes. The introduction of UniRouter’s liquid staking architecture builds upon this foundation, adding layers of liquidity and flexibility while maintaining the core principles of Babylon’s staking model.

Core Components of UniRouter’s Liquid Staking

Signature-aggregated Wallets: UniRouter employs signature-aggregated wallets using a MuSig2 aggregation signature. This setup ensures decentralized custody and enhances the security of staked assets.

Staking-derivative Tokens: Upon staking their bitcoins, users receive staking-derivative tokens on UniRouter chain, which represent their staked value. These tokens provide immediate liquidity and can be used in various DeFi activities.

Delegated Validators: UniRouter designates validators to manage the staking process. These validators are responsible for initiating and managing the staking transactions within the Babylon platform.

Node Operators: Specialized node operators, appointed by UniRouter validators, are responsible for validating external transactions and maintaining network integrity.

Reward and Penalty Mechanism: Rewards from the validation process are distributed to staking-derivative token holders. In the event of protocol violations, penalties are shared among all stakers, reducing individual risk.

Operational Flow

Staking Initiation: Users stake their bitcoins by transferring them to UniRouter’s signature-aggregated wallet.

Token Issuance: In return, users receive an equivalent amount of $stbtc tokens, facilitating immediate liquidity.

Validation Process: UniRouter validators initiate the staking transactions, and the appointed node operators undertake the validation duties on the Babylon chain.

Rewards Distribution: Rewards earned from the staking process are distributed to the holders of $stbtc tokens, proportional to their staked amount.

Penalty Amortization: In case of any misconduct leading to penalties, the impact is distributed across all stakers, ensuring a balanced risk mechanism.

Conclusion

UniRouter’s liquid staking architecture offers a unique blend of security, liquidity, and flexibility. By tokenizing staked assets and democratizing the staking process, it enables a wider audience to participate in and benefit from the growing DeFi ecosystem. This architecture not only simplifies Bitcoin staking on the Babylon chain but also paves the way for innovative financial applications and use cases.

Last updated